Belanjawan 2021 hidupkan semula ekonomi Malaysia. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Malaysia Sst Sales And Service Tax A Complete Guide

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

. This I believe is the PH airport terminal fee. 30 of the amount exceeding Rs10 lakh An additional cess of 4. Malaysia has undertaken a review of its tax incentives and excluded royalties and intellectual property income from its tax incentives in line with the requirements of BEPS Action 5 Counter Harmful Tax Practices More.

From Rs500001 to Rs1000000. Despite the reduced fertility rate Malaysias population will continue to grow albeit at a decreasing rate for the next few decades because of its large number of reproductive-age women. In the 2022 Budget announcement it is proposed that with effect from 1 January 2022 foreign-sourced income FSI of Malaysian tax residents both companies and individuals which is received in Malaysia will be subject to tax.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting. Tax exclusions certificates have been sent to customers via email.

There should be another item called the PH PSC Value Added Tax. For unutilised PS losses accumulated as at YA 2018 where the incentive has already expired these losses can be carried forward for another 7 YAs until YA 2025. Tax system should be more competitive says manufacturers group.

Ascertain doubly taxed income. Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals corporations trusts and othersTax evasion often entails the deliberate misrepresentation of the taxpayers affairs to the tax authorities to reduce the taxpayers tax liability and it includes dishonest tax reporting declaring less income profits or gains than the amounts actually earned overstating. 20 of the amount exceeding Rs5 lakh.

This means you should not withhold income tax or VAT during the following periods. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Whichever is less relief is given to that extent.

FMM proposes corporate individual income tax waivers for 2020 2021. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. This relief is applicable for Year Assessment 2013 and 2015 only.

The youth population has been shrinking and the working-age population 15-64 year olds has been growing steadily. Resident companies are taxed at the rate of 24. June 1 2018 until March 31 2019.

Ascertain tax by applying Indian rate of tax as well as rate of foreign country separately. Air Passenger Departure Tax PHP 77059 is this the travel tax. Know about Income tax department slabs efiling calculation payments refunds and Latest updates in Tax.

Belarus took a very unique approach to cryptocurrencies back in 2018. FMM proposes income tax waivers for this year and 2021. Malaysia follows a progressive tax rate from 0 to 28.

State or Federal Territory 2020 GDP RM Million 2019 GDP RM Million 2018 GDP RM Million 2017 GDP RM Million 2016 GDP RM Million 2015 GDP RM Million 2014 GDP RM Million 2013 GDP RM Million 2012 GDP RM Million 2011 GDP RM Million 2010 GDP. Instead of creating crypto tax laws like many other countries in March 2018 the Eastern European state legalized crypto activities and exempted all individuals and businesses from crypto tax until 2023. There will be a transitional period from 1 January 2022 to 30 June 2022 where FSI remitted to Malaysia will be taxed at the rate of 3 on gross.

Please include these when submitting payment to Google. January 1 2018 until June 30 2018. This terminal fee should be refundable for OFWs with OEC.

So the total is the P550 terminal fee. Malaysias labor market has successfully absorbed the. 5893 which usually amounts to P5893.

We are customizing your profile. The following table is the list of the GDP of Malaysian states released by the Department of Statistics Malaysia. As such - all crypto activities - including activities like mining and day trading - are viewed as.

From Rs250001 to Rs500000. The new metric brings Malaysias absolute poverty rate to 56 in 2019. All calculation in Rupees Salary from India Salary from Australia Total Income- 690000 Tax on above in India-70000 Ascertain doubly taxed income ie 240000.

The household income report also raised Malaysias average poverty line income PLI to RM2208 from RM980 in 2016. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie. I 5000 Limited - year of assessment 2014 and.

FMM proposes corporate individual income tax waivers for 2020 2021. This means that almost 6 out of 100 households in Malaysia could not afford to meet basic needs like food shelter and clothing.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

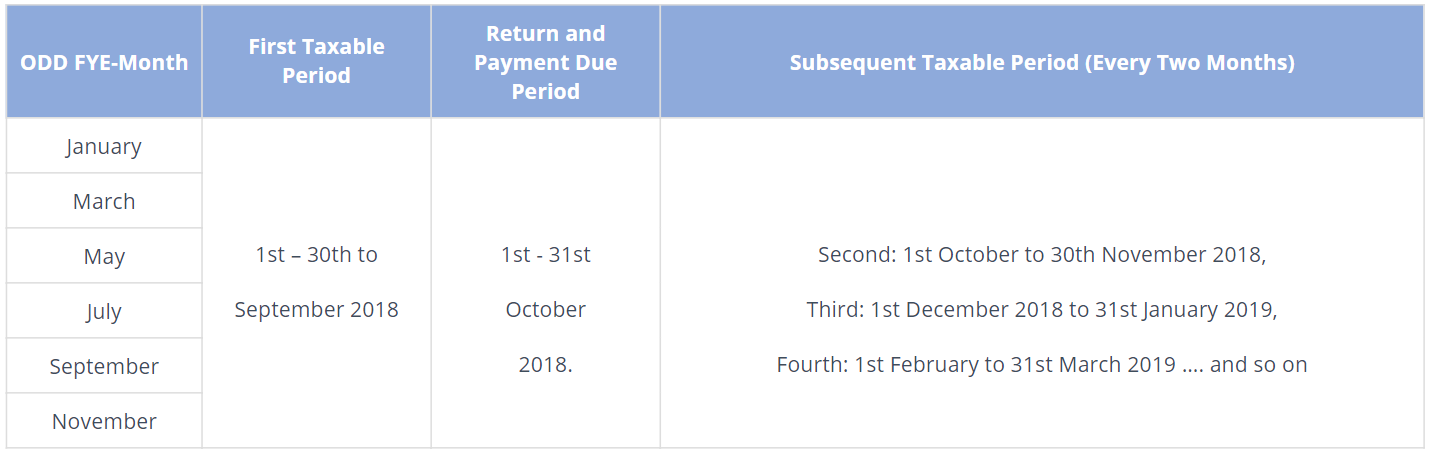

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Income Tax Malaysia 2018 Mypf My

How Much Does A Small Business Pay In Taxes

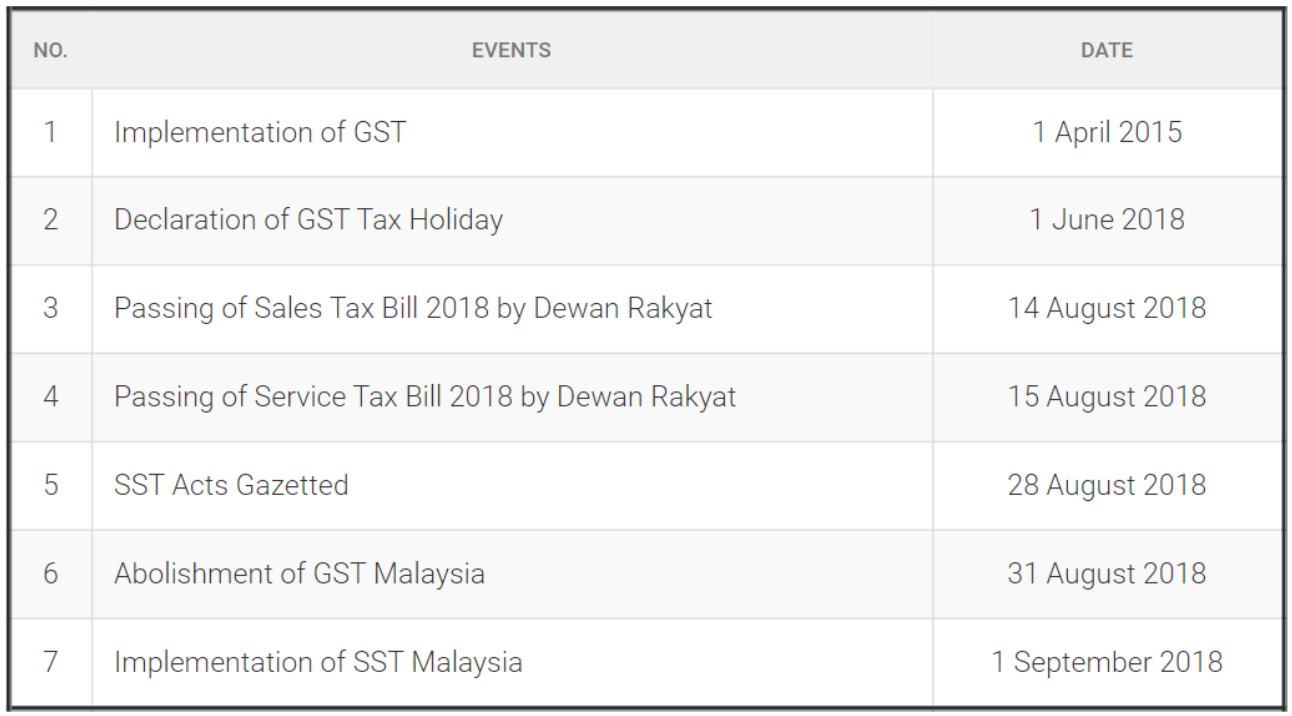

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Payroll And Tax Activpayroll

Income Tax Malaysia 2018 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

How Train Affects Tax Computation When Processing Payroll Philippines

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Income Tax Malaysia 2018 Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Do You Need To File A Tax Return In 2018